International Goldfields Limited. (IGS)

Latin Gold Joint Venture

14 February 2013 - CEO: Travis Schwertfeger

International Goldfields Limited (ASX: IGS) is a gold focused explorer with a portfolio of projects located in the established mining districts of Western Australia, Mali, and Brazil. IGS has entered into a conditional heads of agreement (HoA) to merge with US based Santa Fe Gold Corporation (OTCBB: SFEG) with projects in New Mexico US, creating a global gold and silver company.

In this Open Briefing®, Travis discusses

- Latin Gold joint venture with Biogold

- Santa Fe merger progress

- Summit Mine production

openbriefing.com

International Goldfields Limited (ASX: IGS) recently announced that its 93% owned subsidiary, Latin Gold Limited has entered into a memorandum of understanding (MoU) with Brazil domiciled Biogold Investment Fund, whereby each entity will contribute their respective land holdings in the south eastern extent of the Juruena Belt in Brazil into the private entity Ouro Paz. What assets and benefits does Biogold bring to the joint venture (JV)?

CEO Travis Schwertfeger

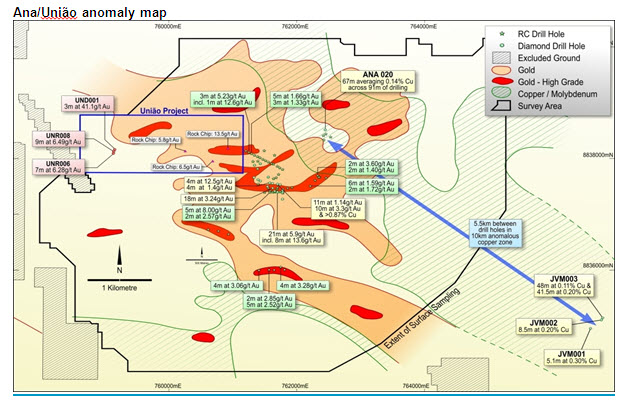

In the Juruena Belt, Biogold’s União prospect is a mature exploration asset, host to a small gold resource with higher average gold grades than our Ana prospect across mineable widths. The resource is defined under a very small portion of an extensive area of shallow oxide mining that has been producing gold from shallow high grade primary mineralisation for several years. Production to date has been on a very small scale, with pits ranging from 2m to 15 m depths excavating partially weathered material and processed by gravity extraction with very low recoveries.

Biogold acquired the project area with the concept of significantly expanding production by open pit mining methods and building a mill to recover gold by cyanidation process. Preliminary metallurgical studies show encouraging results for improving gold recoveries by this method and the project has very well refined drill targets for an extension of resources to support an investment decision in the near term.

openbriefing.com

The JV will hold over 2,700 m² along the Juruena Belt with Latin Gold holding a 35% interest in the JV and Biogold a 65% interest. What is the rationale for Latin Gold relinquishing 100% control of the Ana prospect for 35% of the JV? What are the key benefits for shareholders in this transaction?

CEO Travis Schwertfeger

The proposed JV in Brazil exposes IGS to a more mature exploration asset with significantly increased probability of positive economic assessment and brings forward a timeline for development and production for the project.

The advanced asset at União was given relatively high value in the transaction, and Biogold is an attractive partner in Brazil. Biogold is a well funded group that has attracted Brazilian management and technical staff with strong backgrounds in both exploration and project development and is well suited for the objectives of the JV.

IGS’s intention for the Latin Gold Project prior to this JV was to focus on the Ana prospect area to progress a resource for future development and continue to rationalise its land position in Brazil by relinquishing surrounding mining licences with high exploration and holding costs. For IGS investors, this JV represents an opportunity to retain a larger land package for future exploration by sharing exploration risk with Biogold, in addition to significantly de-risking the economic viability of the Ana/União area and bringing near term production potential.

openbriefing.com

The União prospect that will be contributed to the JV by Biogold, has been subject to substantial drilling, with significant results including 3 m at 41.1 g/t Au from 40.5 m and 22 m at 3.65 g/t Au from 15 m. How important is União to understanding the geology of the Juruena Belt?

CEO Travis Schwertfeger

The gold mineralisation in the União prospect provides the best textures observed by IGS in the region, evidencing epithermal style mineralisation, with multiple mineralising events overprinting the same zone. In comparison with the mineralisation at the PF Quartz Vein zone at Ana, the União results are low in copper, and much higher in silver, with the 3 m at 41.1g/t Au also returning 164 g/t Ag, the 22 m at 3.65 g/t Au intercept including 3 m at 20 g/t Ag, and the União resource overall averaging about a 7:1 Ag to Au ratio.

Overall, the Ana/União area is a district scale play on a single extensive mineralisation system with a change in the metallogenic zonation along the 2.6 km strike extent between the two drilled zones. The shear zone that hosts the União and PF vein zone is an important mineralising control and exploring the full extent of the mineralised system as a consolidated project will certainly accelerate the understanding of controls on mineralisation within the Juruena Belt.

openbriefing.com

What are the JV’s key planned activities for 2013 and 2014?

CEO Travis Schwertfeger

Drilling on the União prospect commenced in the second week of January, and at present is fully funded by Biogold until completion of the final JV agreement. Ouro Paz geologists will focus on extension drilling to resources at the União prospect, and move on to resource extension targets and some initial drill tests in and around the Ana prospect area later this year.

A resource estimate under Brazil mining law has already been completed for União in conjunction with a preliminary economic assessment in support of an application for a mining licence. The data and resource report are currently being reviewed to determine what work is required to define a JORC compliant resource category for disclosure to the ASX. We hope to release JORC compliant estimates for both União and PF Vein Zone at Ana by May this year and update resource estimates incorporating 2013 drill results by August 2013. This will support the preliminary economic assessment required for additional government reporting in Brazil by late August.

Biogold has also completed an application for a one year trial mining permit that would allow the JV to complete bulk tonnage metallurgical tests and optimisation studies for gold recovery. Positive outcomes from these tests and updated JORC compliant resource estimates will put the company in a position to complete a feasibility study in 2014 to optimise expansion of the operations at União and acquire appropriate mining and environmental permits for the project to commence development work.

openbriefing.com

In October, IGS announced a heads of agreement (HoA) with Santa Fe Gold (OTCBB: SFEG) conditional on a number of factors, including shareholder support, consolidation of capital, and an American Depository Receipts (ADR) listing through OTCBB in the US. What is the progress of this HoA and is the merger still on track for completion in the second quarter 2013?

CEO Travis Schwertfeger

Yes, required disclosure for filing an F4 to the SEC in the US has been amended in line with the final agreement for the merger, which is expected to be executed soon. Once the US filings are accepted by the SEC and additional conditions for merger as outlined in the HoA are met, Santa Fe will be in a position to schedule a shareholder meeting to formally approve the transaction.

openbriefing.com

The agreement in Brazil follows closely the announced merger with Santa Fe. Does the JV in Brazil align with the rationale for completing a merger with Santa Fe?

CEO Travis Schwertfeger

Post completion of the merger, IGS anticipates achieving in the September quarter a production target of 30,000 oz AuEq per annum. The Mogollon project optioned by Santa Fe provides a high probability to double that production to 60,000 oz AuEq per annum in late 2014 with relatively low capital costs, utilising spare capacity at Santa Fe’s Lordsburg Mill. It is the goal of IGS to then utilise positive cash flow from these smaller operations to support development of the Ortiz Project in New Mexico, host to a 1 million oz Au resource and targeted to increase the company’s production profile to 160,000 oz Au equivalent per annum by 2016.

The JV in Brazil fits very well with the objectives of the company in the Santa Fe merger. The intention of IGS management has been to bring production and cash flow into the company in a market where exploration success has brought limited reward, and capital raising to advance early stage exploration projects has been challenging. The Brazil project is anticipated to complement the production increases targeted for the Summit and Mogollon projects.

Operating in Brazil with a JV partner will put IGS in a position to maintain exposure to an asset with increased potential for development. By capping the spend in Brazil for 2013 and with JV financing assistance as outlined in the MoU, IGS can maintain focus on development of production assets in New Mexico in the short term. Then, with production and cash flow objectives realised in New Mexico in 2013, IGS will be in a strong position to maintain its proportion of development expenditure in Brazil and advance the asset to support long term objectives for an increasing gold production profile.

openbriefing.com

Sante Fe recently announced changes regarding production activity at the Summit Mine. What are the implications for IGS of these developments?

CEO Travis Schwertfeger

As announced by Santa Fe on 6 February, the Summit Mine has increased its production activity from a five days per week to a seven day per week schedule. The change in schedule includes an increase in staff at the mine and comes with an increasing number of working faces available in the mine as development approaches the Main Zone ore bock. The increased production activity will allow the mine to advance and establish stopes earlier in the higher grade portions of the modelled resource.

No significant increase in ore tonnage is anticipated from the change other than improved consistency in meeting the mine’s 10,000 tonne per month production objectives, which have suffered at the expense of prioritised development work in the past few months.

The combination of steady development work and higher ore tonnage objectives is expected to result in decreasing cash costs and increasing gold and silver production over the next 12 months as the Summit Mine moves into the Main Zone ore block that contains the highest grade portions of the resource and will provide the majority of production tonnage for the next three years.

openbriefing.com

Thank you Travis.

For more information about International Goldfields, visit www.intgold.com.au or call Travis Schwertfeger on (+61 8) 9221 7729

DISCLAIMER: Orient Capital Pty Ltd has taken all reasonable care in publishing the information contained in this Open Briefing®; furthermore, the entirety of this Open Briefing® has been approved for release to the market by the participating company. It is information given in a summary form and does not purport to be complete. The information contained is not intended to be used as the basis for making any investment decision and you are solely responsible for any use you choose to make of the information. We strongly advise that you seek independent professional advice before making any investment decisions. Orient Capital Pty Ltd is not responsible for any consequences of the use you make of the information, including any loss or damage you or a third party might suffer as a result of that use.

Competent Person Statements

The information included in this release that relates to Santa Fe Gold resources for the Ortiz Project is based on information compiled by Michael G. Hester, FAusIMM. Mr. Hester is employed as Vice President and Principal Mining Engineer by Independent Mining Consultants, Inc. (IMC) of Tucson, Arizona, USA, and has worked as a consultant in resource modeling, mine evaluation and mine development for 33 years in precious and base metal deposits. Mr. Hester has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person. Mr. Hester consents to the inclusion in the release of the matters based on his information in the form and context in which it appears.

The information included in this release that relates to Santa Fe Gold resources for the Summit mine is based on information compiled by Douglas F. Irving, who is a professional member of a ‘Recognised Overseas Professional Organisation’ (The Association of Professional Engineers and Geoscientists of British Columbia) included in a list promulgated by the ASX from time to time. Mr. Irving is employed by Chapman, Wood and Griswold, Inc. and has worked as a consultant in exploration and mine development for 40 years in precious and base metal exploration. Mr. Irving has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person. Mr. Irving consents to the inclusion in the release of the matters based on his information in the form and context in which it appears.

The information in this release that relates to exploration results for Brazil or West African Projects is based on information compiled by Mr Travis Schwertfeger. Mr Schwertfeger is the Chief Executive Officer of International Goldfields Limited. Mr Schwertfeger is a member of The Australian Institute of Geoscientists and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Schwertfeger consents to the inclusion in the report of the matters based on information in the form and context in which it appears.

Latest Open Briefings

27 Nov 2012

Rationale for Santa Fe Gold Merger